Experience a flexible managed account solution designed to meet the unique needs of your business model – no matter how you engage with your clients. WealthPort offers both customization and efficiency, allowing you to focus on your role as a financial professional.

Advisor-directed Models

Team-directed Model Management

CAAP®1 Strategist-directed Model Management

Separately Managed Accounts (SMAs)

Unified Managed Accounts (UMAs)

WealthPort Proposal Generation

WealthPort Proposal Generation

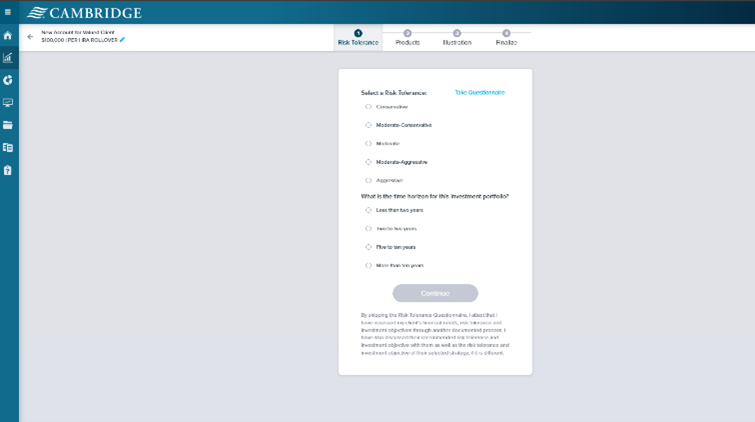

Proposal Generation – Risk Tolerance Questionnaire

Proposal Generation – Risk Tolerance Questionnaire

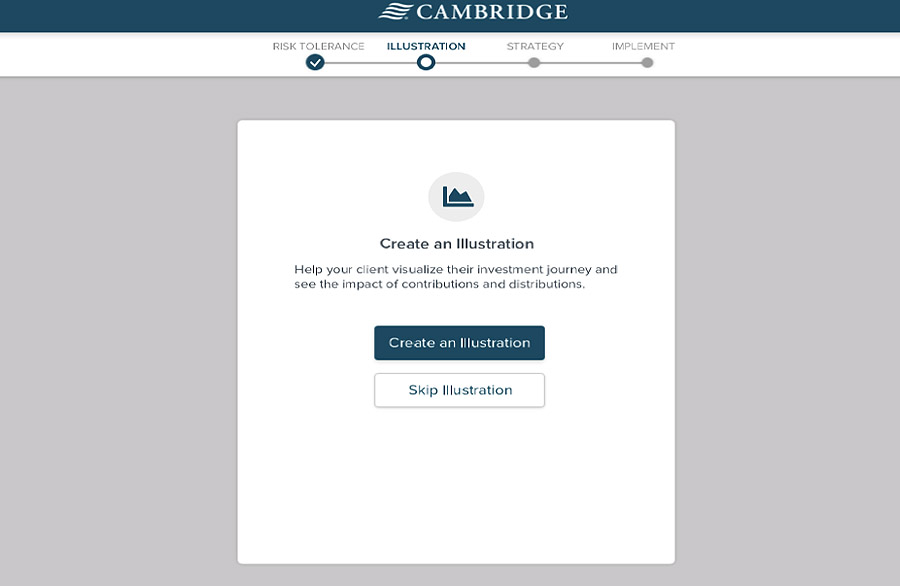

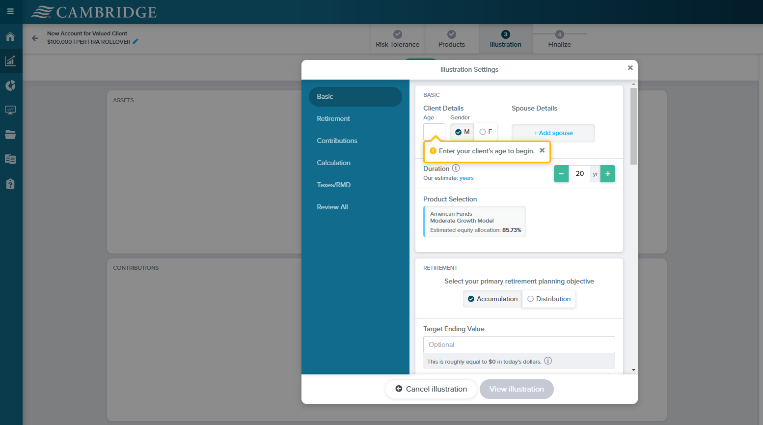

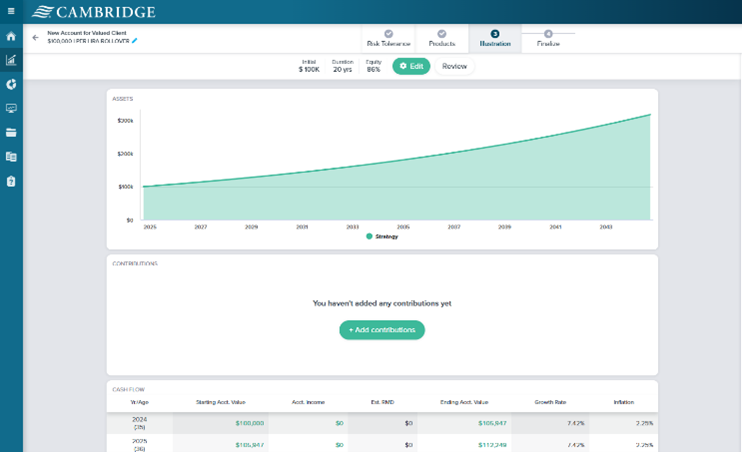

Proposal Generation – Illustration

Proposal Generation – Illustration

Proposal Generation – Client Information

Proposal Generation – Client Information

Proposal Generation – Assets

Proposal Generation – Assets

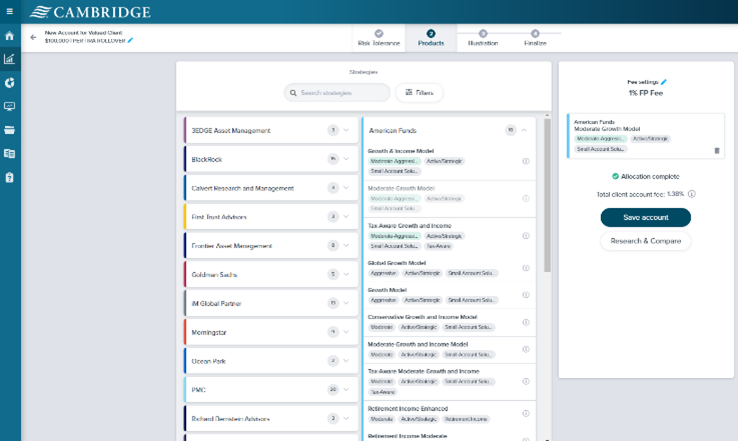

Proposal Generation – Product Selection

Proposal Generation – Product Selection

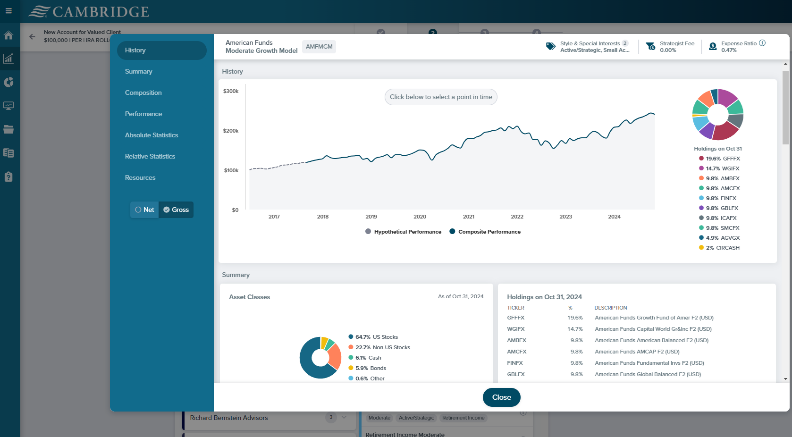

Proposal Generation – Selected Model

Proposal Generation – Selected Model

| Advisor-directed | Team-directed | CAAP | UMA | |

|---|---|---|---|---|

| Model creation responsibility | Financial professional | Financial professional on team |

Cambridge | Financial professional/Cambridge |

| Trading responsibility | Financial professional | Financial professional on team |

Cambridge | Cambridge |

| Strategy performance available | No | Yes* | Yes | Yes |

| Pricing includes: | ||||

| Clearing and custody** | x |

x |

x |

x |

| CIRStatements Performance reporting | x |

x |

x |

x |

| Strategists due diligence | x |

x |

||

| Overlay management | x |

*Team-directed strategy performance is available with prior approval and for an additional fee.

**Clearing and custody includes: All trading and ticket charges, as well as some of the more common ancillary charges from the custodians, including the IRA maintenance fee. A full list of charges covered by the WealthPort Program Fee is available from a Business Director.

The WealthPort Program Fee is charged on an account-by-account basis, however the following discounts may apply: Household WealthPort Program Fees across related clients so all accounts in one household benefit from the lower tiers applied on the total value of household assets; AUM discounts are now available based on assets under management under an advisor code in WealthPort. These discounts will directly benefit the client as a discount to their WealthPort Program fee. When creating and/or managing a household, please consider the following questions:

Are the potential household members related?

Do all of the potential household members know one another?

Would all potential household members be comfortable sharing any/all of their account information with one another, without restriction?

Would you feel comfortable sharing any/all account information with any and/or all of the members in the household, without restriction?

Relationship Management

Whatever your business needs, WealthPort has the level-fee solutions and technology to support you and your clients.

Path to Trading Efficiency

Model Management

Block Trading

Single Order Entry

Next Generation Managed Account Experience

WealthPort provides financial professionals with the ability to serve clients according to their unique business model while choosing from, and using, multiple management styles based on their investing client’s preference. WealthPort also features a suite of technology solutions to support these choices.

Cambridge WealthPort®

Cambridge WealthPort is designed by advisors and built with Cambridge’s customizable technology.

Features

- Proposal Generation

- Model Management

- Trading/Rebalancing

- Fee Billing

- Reporting

- Research

Freedom and flexibility

- Serve your clients according to your unique business model

- Choose from, and use, multiple management styles based on client preference

More for clients with less work

- Easy to use

- Time saving

- Cost effective

Featured Insights

The Pillars of True Independence

Get our succession strategy outlining Cambridge’s commitment to internal control and preserving the independence of the financial advisors we serve.

Building Something Wonderful

After nearly 45 years in business, we recognize it has always been about the people. Watch how Eric Schwartz, Founder and Co-Chairman of the Board, just wanted to build something wonderful.

Find Stability in a Shifting Landscape

Hear from our CEO and Co-Chairman of the Board, Amy Webber, on why Cambridge has remained internally controlled for nearly 45 years1–and why we’re built to stay that way for the long haul.