On behalf of the entire Cambridge Executive Team, we’re excited you’re here and honored to support you through your due diligence process.

Office of the CEO

Office of the CEO

Amy Webber, Chief Executive Officer

Colleen Bell, President, Innovation and Experience

Jeff Vivacqua, President, Growth and Development

Seth Miller, President, Advocacy and Administration

Why Cambridge

Top Five Reasons Financial advisors Choose Cambridge

1

Flexibility - You Control the Journey

As an independent business owner, control matters—and we believe flexibility and control are deeply intertwined. Whether you are focused on growing your business, improving office efficiency, enhancing your marketing strategy, or simply providing your clients with access to a wide range of products, we provide the flexibility you need to run your business your way.

2

Commitment to Internal Control

As consolidation reshapes the financial services industry, Cambridge remains firmly committed to independence and internal control. Guided by our senior leadership team, our long-term plan is designed to preserve our independent structure—so financial advisors can operate with clarity, stability, and complete confidence.

3

Access to Senior Leadership

Cambridge’s senior leadership team is approachable, engaged, and committed to understanding what makes your business unique. Founder and Co-Chairman Eric Schwartz and CEO and Co-Chairman Amy Webber continue to lead with a focus on long-term independence and internal control—prioritizing stability for financial advisors like you.

4

Common-sense Compliance

Innovation drives our industry forward but creativity shouldn’t be stifled by a one-size-fits-all compliance model. That’s why Cambridge takes a common-sense approach. Our Compliance Department collaborates with you to “find a way to yes,” and if your first idea doesn’t align with regulations, we work with you to explore compliant alternatives that support your goals.

5

Broad Product Footprint and Specific Advisory Platforms

Building on flexibility, Cambridge offers one of the industry’s broadest product footprints. With access to over 500 mutual fund companies and a comprehensive range of investment options, we help position your clients to meet their financial goals. Known as TheFeeExperts®4, Cambridge provides advisory platforms designed to simplify doing business for financial advisors and planners. For decades, we’ve shaped our business around how advisors work—and we look forward to the opportunity to serve you and your clients.

¹Cambridge and TAG Advisors are not affiliated.

²Cambridge and Financial Partners of Louisianna, LLC are not affiliated.

³Cambridge and Retirement Plan Advisors are not affiliated.

⁴TheFeeExperts® is a registered trademark of Cambridge Investment Research, Inc. for its investment advisory service for investment managers.

⁵Cambridge and Pivotal Financial Advisors are not affiliated.

Testimonials may not be representative of the experience of other customers and are no guarantee of future performance or success.

Why Cambridge

Top Five Reasons Financial advisors Choose Cambridge

1

Flexibility - You Control the Journey

As an independent business owner, full control should be in your hands. From our perspective, flexibility and control are intertwined. Whether you are focused on growing your business, improving office efficiency, enhancing your marketing strategy, or simply providing your clients with access to a wide range of products, we can supply the flexibility you need to run your business your way.

2

Commitment to Internal Control

Consolidation activity continues to sweep through the financial services industry at an alarming rate. Led by our senior leadership team, Cambridge continues to focus on independence and internal control. Our long-term plan for the firm is designed to preserve our independent status, so our financial advisors can operate with complete confidence.

3

Access to Senior Leadership

Our goal is to put you in the best position to serve your clients. The Cambridge senior leadership team makes every effort to understand the unique features of your business and is easily accessible. A nine-person executive team leads Cambridge – including Founder and Executive Chairman, Eric Schwartz, and Chief Executive Officer, Amy Webber – who continue to focus on long-term independence and internal control.

4

Common-sense Compliance

The springboard to innovation is creativity. Innovative ideas and strategies are pushing our ever-evolving industry forward daily. That is why we do not believe in a "one-size-fits-all" approach and managing to the lowest common denominator when it comes to compliance. Our Compliance Department strives to “find a way to yes,” and will collaborate with you to find an alternative solution if your first choice does not meet the requirements of the current regulatory framework.

5

Commitment to Internal Control

Building on flexibility, Cambridge supplies one of the broadest product footprints in the industry. Over 500 mutual fund companies are available for direct business, and our complete universe of company and product offerings features a wide range of investment choices designed to put your clients in the best position to meet their goals. Known as TheFeeExperts®3 Cambridge supplies advisory platforms designed to make doing business easy for financial advisors and planners. For decades, we’ve crafted our business towards how financial advisors conduct business, and look forward to the opportunity to serve you and your clients.

About Us

We are proud to supply independent financial professionals with the support to foster long-term client relationships.

Strength and Stability

$1.88B

in gross revenues1

$235B

in assets under advisement2

#7

largest broker-dealer based on gross revenue3

#9

independent broker-dealer in total account assets4

#9

fastest-growing independent broker-dealer5

A Leading Independent Firm

900

home office associates providing personalized support

4:1

financial advisor to associate ratio for dedicated service

61%

of Cambridge associates are women

Financial Advisor Community

4,000

producing financial advisors

885

Cambridge CFPs®

18%

of Cambridge financial advisors are women

16%

Cambridge financial advisors are under 40

Nationwide Reach

Home office locations in Fairfield, Iowa and Phoenix, Arizona

All data as of 6/30/2025

1Year to date actual annualized.

2AUA (Assets Under Advisement) reflects fee-based and independent RIA assets plus commission assets.

3Based on revenue growth. Ranking received in InvestmentNews Magazine's 2024 independent broker-dealer industry survey rankings.

4Ranking received in Financial Planning Magazine’s 2024 IBD Elite survey rankings.

5Based on revenue growth. Ranking received in Financial Planning Magazine's 2024 IBD Elite survey rankings.

Service That Powers Your Success

At Cambridge, we know that making a move is a big decision. That’s why our high-touch service and unwavering attentiveness make all the difference. From day one, our advisors are supported by a team that’s fully invested in their success. The results speak for themselves—our commitment to exceptional service empowers advisors to achieve new levels of success and focus on what matters most: their clients and growth.

The Cambridge Difference

Real Support,

Real People

Over 88% of calls are answered by a live person, giving you the personal attention you deserve1

.

Fast,

Reliable Service

Our average phone hold time is under four minutes—just 90 seconds in key service areas—so you get the answers you need, quickly1

Stay in Line Without

Staying on the Line

Our call-back feature lets you keep your place in the queue while you focus on other things

1Data as of 2/28/25

Who We Serve

Ways to Join

At Cambridge, we’ll never ask you to fit into a mold. We cater to thousands of distinct and unique business models. Choose to operate as a solo financial advisor, ensemble, multi-financial advisor team, or enterprise while reporting directly to Cambridge as an established field office.

Join Cambridge and report directly to the home office. You’ll enjoy our comprehensive service and support and build a personal relationship with your regional director who acts as your supervisor. |

Join one of the hundreds of offices at Cambridge and receive strength and support from both Cambridge and your new office. Offices of every size thrive here, so you can easily find the right fit.

Bring your group to Cambridge. We understand the distinctive needs of business leaders and their multi-financial advisor and enterprise practices. We specialize in supporting your growth through recruiting aid, practice management coaching, and acquisition solutions.

Join through Cambridge Investment Research Advisors, Inc. (CIRA), our RIA, your independent RIA, or an existing independent RIA. Cambridge has garnered an industry reputation as TheFeeExperts®1. Decades ago, our Founder and Co-Chairman of the Board, Eric Schwartz, pioneered the hybrid business model. Since then, we have continued to adapt, becoming an ideal home for advisory professionals who value choice.

Broker-dealers have the choice to partner with us and roll up under Cambridge as a newly formed multi-financial advisor team or enterprise.

Supported Business Models

You’ve worked hard to build your business, and you deserve the freedom to run it on your own terms.

Cambridge offers the flexibility and support you need to grow your business your way — helping you serve your clients and reach their investing goals without compromise.

We honor your independence by giving you the freedom and tools to create, and continuously shape, your business vision.

Experience freedom from:

- Sales quotas

- Proprietary products

- Stringent compliance requirements

As an OSJ leader, you need autonomy to run your business your way—without limits or rigid structures getting in the way.

We recognize that the OSJ model isn’t one-size-fits-all. We partner with experienced leaders like you to deliver flexible, scalable solutions—built to support your vision and the financial advisors you serve.

With Cambridge, you get the best of both worlds: independent ownership of your business and the freedom to shape it how you see fit.

What You Can Expect

- OSJ-level pricing

- Customizable payouts for the advisors you support

- Flexible platforms, multiple clearing options, and one of the broadest product footprints in the industry to help you meet the needs of a wide range of recruits

- A “common-sense” Compliance Department that’s collaborative and accessible

- Dedicated recruiting support to help you grow

Banks and Credit Unions

Choose from various program structures, unique compensation arrangements, and custom client ownership scenarios that are fully adaptable to your financial institution. Plus, enjoy access to various investment products, industry-leading technology, and common-sense compliance support.

Cambridge’s specialized resources include:

Specialized client prospecting solutions

Professional training and development

Practice management coaching and consulting

Dedicated marketing support

Cambridge is the ideal partner for independent registered investment advisors (RIAs).

Experience the freedom of running your RIA—while receiving the support you need to grow your legacy.

What You Can Expect

- A flexible range of advisory platforms

- In-house RIA consulting

- Growth and coaching programs

- Business continuity planning

- Succession and acquisition opportunities tailored to your goals

Rising regulatory demands, increasing operational costs, and shifting industry expectations are leading many broker-dealer owners to explore new ways to protect their independence while easing the day-to-day pressure.

If you're considering a sale, merger, or transitioning into an OSJ under a larger firm, Cambridge offers a strategic path forward—one that honors the business you’ve built and gives you room to grow.

What You Can Expect

- Reduce overhead and regulatory burden

- Eliminate the risk associated with operating your own broker-dealer

- Maintain autonomy while gaining access to scalable infrastructure

- Remain independent while continuing to build your legacy

1TheFeeExperts® is a registered trademark of Cambridge Investment Research, Inc. for its investment advisory service for investment managers.

Compensation and Expenses

Joining Direct

We understand the costs of running your business and the compensation you receive directly impacts the services you provide your clients. We offer competitive compensation packages to keep your legacy going for many years.

Joining an Existing Office

Join one of our hundreds of existing offices to receive tools and support from Cambridge and your new office. Payout is negotiated between the financial advisor and the enterprise leader/OSJ. Revenue, services offered, and facilities supplied are some of the many factors in the payout discussion.

Expenses

| Monthly | Cost |

|---|---|

| Cambridge Technology | $275/month |

*See fee addendum for details.

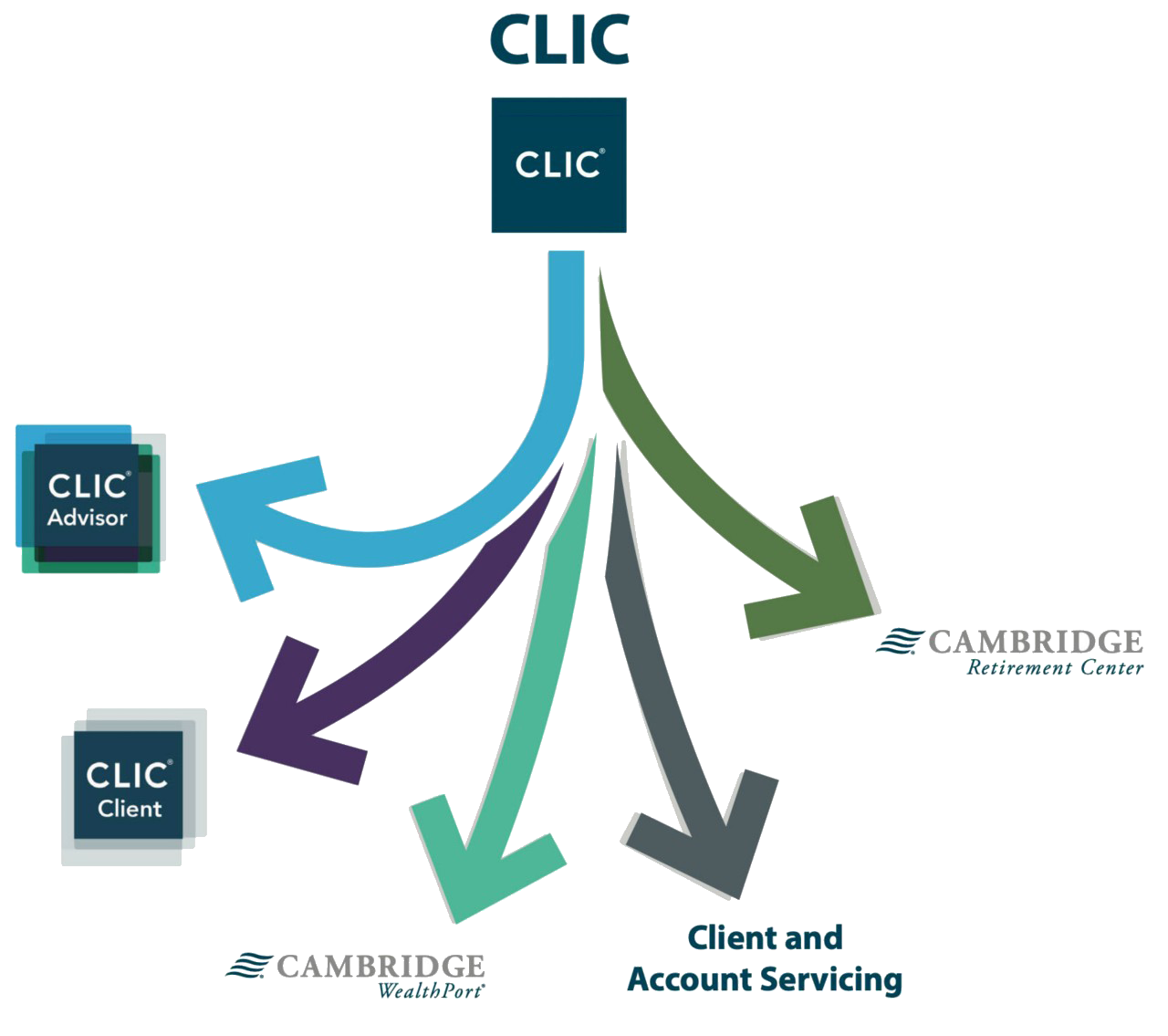

For $275 per month, the Cambridge Technology Fee supplies advisors with an all-in-one technology package, including CLIC®, our comprehensive online business platform, and other customizable tools. These simplify processes and provide integrated solutions for clients, enhancing advisors’ businesses.

This package is a testament to our commitment to providing advisors with the best possible tools to service their business.

| CLIC Dashboard |

|

| CLIC Advisor – extension of CLIC powered by eMoney |

|

CLIC Client |

|

Clearing Services |

|

| Client and Account Servicing |

|

Compensation Services |

|

Compliance Services |

|

Imaging Services and Document Storage |

|

Managed Account Services |

|

Retirement Center |

|

Office Services – Back-office Ecosystem |

|

| Description | Cost |

|---|---|

| Registered financial advisor | $320.84/month |

| Solicitor | $206.26/month |

Errors and Omissions Insurance Additional Options

| Coverage Description | Cost |

|---|---|

| General | |

| $3,000,000 per claim/$3,000,000 aggregate* | $354.16/month |

| $3,000,000 per claim/$5,000,000 aggregate* | $370.84/month |

| $5,000,000 per claim/$5,000,000 aggregate* | $404.16/month |

| Referral/Solicitor Only/IRIA Advantage | |

| $1,000,000 per claim/$1,000,000 aggregate | $206.26/month |

| CIRA Advantage | |

| $2,000,000 per claim/$2,000,000 aggregate | $300/month |

*Additional coverage levels available upon approval.

Niche Coverage Options

| Niche | Cost |

|---|---|

| Accounting professionals | $25/month |

| Divorce planning | $25/month |

| Cyber Claim Deductible Buy Down – $2,500 Option | $1,000/year, paid in full |

| Cyber Claim Deductible Buy Down – $5,000 Option | $500/year, paid in full |

| Cyber Claim Deductible Buy Down – $7,500 Option | $250/year, paid in full |

| Annual Fees* | Cost |

|---|---|

| IAR registration with Cambridge Investment Research Advisors, Inc. (CIRA) | $175 |

| FINRA fees | $165 initial registration | $615 annual renewal |

| FINRA branch fees | $250 initial registration | $250 annual renewal |

| Fidelity bond | $360 |

| SIPC | $320 |

| Continuing education (CE) regulatory element | $150 |

| State registration renewal | Varies by State |

| Branch state renewal | Varies by State |

*All prices effective as of January 2025.

| À la carte Fees* | Cost |

|---|---|

| WealthPort® block trading and rebalancing tools | Complimentary when using WealthPort |

| CIRStatements - powered by Wove* | $250/month or complimentary when using WealthPort |

| CIRConnect | $30/month for one connection, $40/month for two or more connections, 30-day free trial available |

| Redtail | Plans starting at $39/month per login/user** |

| Wealthbox | 30-day complimentary trial and 10% discount available |

| CLIC® Advisor Advanced Planning - powered by eMoney |

$166.67/month |

| MoneyGuidePro® | $91.67/month |

| Nitrogen*** Elite | $295/month |

| Nitrogen*** Ignite | Pricing available from Nitrogen upon request |

| Nitrogen*** Ultimate | Pricing available from Nitrogen upon request |

| Orion Risk Intelligence - Basic | $250/month |

| Orion Risk Intelligence - Pro | $500/month |

| Orion Risk Intelligence - Elite | $1,000/month |

| Morningstar® | $201.66/month – package price varies |

| Social media monitoring system | $15/month |

| Spam/Anti-virus | Complimentary |

| Email hosting/Domain name | Complimentary |

| Encryption | Complimentary |

| Cambridge Technology Administrative Access - optional | $50/month for licensed and unlicensed administrative professionals |

*Previously Albridge

**A la carte options available upon request

***Previously Riskalyze

WealthPort Fees

| Account Tiers | Advisor-directed | Team-directed | CAAP* | UMA* |

|---|---|---|---|---|

| First $50,000 | 0.25% | 0.25% | 0.40% | 0.45% |

| Next $50,000 | 0.23% | 0.23% | 0.36% | 0.42% |

| Next $150,000 | 0.20% | 0.20% | 0.32% | 0.38% |

| Next $250,000 | 0.17% | 0.17% | 0.27% | 0.35% |

| Next $500,000 | 0.14% | 0.14% |

0.21% | 0.27% |

| Next $1,000,000 | 0.09% | 0.09% | 0.15% | 0.20% |

| Next $3,000,000 | 0.06% | 0.06% | 0.12% | 0.15% |

| Next $5,000,000 | 0.03% | 0.03% | 0.08% | 0.10% |

| Over $10,000,000+ | 0.01% | 0.01% | 0.05% | 0.07% |

*CAAP and UMA have an annual minimum program fee of $250.00. The annual minimum program fee is an annual fee that is paid quarterly.

CAAP Small Account Solutions

The WealthPort Program fee for the Small Account Solutions is 0.50% with no annual minimum program fee. The program fee is calculated based off the total account value.

Clearing Firm Expenses

Ticket Charges

| Fee Amount | ||||

|---|---|---|---|---|

| Product Fee Type | Electronic1 | Non-electronic2 | Frequency | Included in WealthPort Program Fee |

| Stocks, Exchange Traded Funds (ETF)3 | ||||

| International Surcharge/foreign receive and delivery fees4 | $50-$75 | $50-$75 | Per International Security | |

| Purchase Fee | $19.00 | $19.00 | Per Transaction | X |

| Penny Stock (Low Priced Speculative Securities not traded on an exchange under $5.00) | $74.00 | $74.00 | Per Transaction | Not allowed on the WealthPort Program Fee |

| Redemption Fee | $19.00 | $19.00 | Per Transaction | X |

| Mutual Funds | ||||

| Periodic Investments Purchase Fee | $1.00 | $1.00 | Per Transaction | X |

| Exchange/Concession Fee | $0-$19 | $0-$19 | Per Transaction | |

| No Transaction Fee (NTF) Mutual Funds5 | $0.00 | $2.00 | Per Transaction | |

| Purchase Fee | $0-$19 | $0-$19 | Per Transaction | X |

| Redemption Fee | $0-$19 | $0-$19 | Per Transaction | X |

| Systematic Withdrawal Redemption Fee | $1.00 | $1.00 | Per Transaction | X |

| Fund Family Surcharge Fee for Purchase or Redemption for following funds: | $10.00 | $10.00 | Per Transaction | X |

| Options | ||||

| Purchase Fee | $19 + $2 Per Contract | $19 + $2 Per Contract | Per Transaction | X |

| Redemption Fee | $19 + $2 Per Contract | $19 + $2 Per Contract | Per Transaction | X |

| Fixed Income - Corporates, Municipals, Governments, Treasuries, Certificates of Deposit, CMOs, Mortgage-backed Securities, Structured Products, etc. | ||||

| Clearing Charge - Agency Trades | $30.00 | $30.00 | Per Transaction | X |

| Clearing Charge - Principal Trades | $39.00 | $39.00 | Per Transaction | X |

| Unit Investment Trusts (UITs) | ||||

| Purchase Fee | $30-$39 | $30-$39 | Per Transaction | X |

| Redemption Fee | $30-$39 | $30-$39 | Per Transaction | X |

| Precious Metals | ||||

| Purchase Fee | $45.00 | $45.00 | Per Transaction | X |

| Redemption Fee | $45.00 | $45.00 | Per Transaction | X |

| Alternative Investments (Defaults to Client) | ||||

| Purchase Fee | $50.00 | $50.00 | Per Purchase | |

| Redemption Fee | $50.00 | $50.00 | Per Redemption | |

| Miscellaneous Fee | ||||

| Commission Account Service Fee | $3.50 | $3.50 | Per Trade | Not Applicable for WealthPort Accounts |

1 Custom pricing may be available for offices with large trading volumes. Please contact your Cambridge Regional Director for more information.

2 Clearing charges default to electronic pricing. Please note that excessive use of the Cambridge Trade Desk may result in charges equivalent to the non-electronic pricing schedule.

3 Listed stock and ETFs (i.e. stock and ETF orders greater than 4999 shares) may incur a half-a-cent per share charge, which if incurred, will be charged to the advisor. Please contact Cambridge's Trade Desk prior to placing such orders to discuss alternatives.

4 This fee may be charged on securities held in safekeeping, cleared, and/or settled by a foreign entity.

5 Size restrictions on NTF fund purchases may apply. Additional charges may apply.

Ancillary Charges

| Account or Service | Fee Amount | Frequency | Included in WealthPort® Program Fee |

|---|---|---|---|

| Cost basis* | $0.82 | Per statement | X |

| Cost basis – detailed* | $1.07 | Per statement | X |

| Custody and recordkeeping fee (retail inactivity fee)** | $35.00 | Annual | |

| HSA annual maintenance fee | $35.00 | Annual | X |

| HSA liquidation fee | $25.00 | Full account liquidation | X |

| Legal transfer fee** | $150.00 | Per position | |

| Outgoing transfer fee – retail accounts ** | $125.00 | Per outgoing transfer | |

| Paper statement surcharge ** | $1.00 | Per statement | X |

| Paper trade confirmation surcharge** | $1.00 | Per trade confirmation | X |

| Return of legal item** | $75.00 | Per item returned | |

| UBTI tax filing fee** | $300.00 | Annual | |

| Retirement Account Fees | |||

| IRA maintenance fee** | $35.00 | Annual | X |

| Termination fee** | $160.00 ($125.00 termination fee + $35.00 maintenance fee) | Upon closure of the account | |

| Cash Management Services | |||

| Select and Premier Access | |||

| Select Access (ACH direct deposit and bill pay) | $10.00 | Annual | |

| Select Access (ACH direct deposit, bill pay, and checkwriting) | $15.00 | Annual | |

| Select Access (ACH direct deposit, bill pay, and debit card) | $15.00 | Annual | |

| Select Access (ACH direct deposit, bill pay, checkwriting, and debit card) | $20.00 | Annual | |

| Premier Access | $100.00 | Annual | |

| Debit Card | |||

| Select Access in network ATM fee | $1.00 | Per transaction | |

| Premier Access in network ATM fee | No charge | ||

| Select Access/Premier Access out of network ATM fee | Varies based on ATM | Per transaction | |

| Premier Access metal card upgrade | $10.00 | Annual | |

| Bill Pay | |||

| Unlimited Bill Pay | No charge | ||

| Bill Pay Insufficient Funds | $20.00 | Per event, per investor | |

| Bill Pay Check Photocopy | $20.00 | Per check | |

| Misc. | |||

| Select Access personal checkbook reorder | No charge | ||

| Select Access deposit slip order | No charge | ||

| Select Access/Premier Access stop payment fee | $10.00 | Per stop payment | |

| Select Access/Premier Access returned check fee | $15.00 | Per returned check | |

| Select Access/Premier Access style 38 checkbook reorder – includes 500 checks and 90 deposit slips | $55.00 | Per reorder | |

| Select Access/Premier Access check copy request | $2.50 | Per check copy requested | |

| Other Check Management Services | |||

| Check request | |||

| Overnight courier fee** | $13.00 Varies by delivery address effective November 17, 2025 |

Per overnight request | |

| Overnight Saturday delivery fee** | Varies by delivery address | Per overnight request | |

| Mailgrams** | $5.00 | Per mailgram | |

| Margin extension** | $20.00 | Per extension | |

| Returned EFT fee | No charge | ||

| Returned check fee – retail account** | $15.00 | Per returned check | |

| Returned check fee – retirement account** | No charge | ||

| Stop payment/stop check fee – retail account** | $20.00 | Per stop payment | |

| Stop payment/stop check fee – retirement account** | No charge | ||

| Wire transfer** | $15.00 | Per wire request | |

| Investment Specific | |||

| Alternative investment holding fee for registered positions** | $35.00 for registered positions | Annual – per position, maximum of $500.00 | |

| Alternative investment holding fee for non-registered positions** | $125.00 for non-registered positions | Annual – per position, maximum of $500.00 | |

| Alternative investment document review (due diligence)** | $100.00 | Per review | |

| Alternative investment purchase, redemption, or re-registration fee** | $50.00 | Per purchase, redemption, or re-registration | |

| Equity dividend reinvestment | No charge | ||

| Physical reorganization** | $150.00 | Per reorganization | |

| Restricted stock – returned security priced at $1.00 or less** | $11.00 | Per returned security | |

| Restricted stock – service request (legend removal, gifting, re-registration)** | $150.00 | Per service request | |

| Restricted stock – unauthorized sale penalty** | $40.00 | Per unauthorized sale | |

| Safekeeping fee** | $15.00 | Per position per month | |

| Transfer and ship – only available on non-DRS eligible securities (DTC transfer or physical certificate request) | $500.00 | Per request | |

| Transfer and ship DRS eligible securities (outgoing statement sent to transfer agent)** | $15.00 | Per request | |

| Transfer and ship DRS eligible securities (incoming statement sent to transfer agent) | $15.00 | Per request | |

| Voluntary reorganization** | $20.00 | Per reorganization | |

| Securities and Exchange Commission Fee Rate | |||

| SEC Section 31 | $0.00 per $1 million for covered sales | Per transaction - effective May 15, 2025 | |

Asterisks show who the charges defaults to and who can pick up the charge:

*Defaults to the financial professional.

**Defaults to the client, but the financial professional may choose to reimburse.

***Client charge only.

Note: If an account does not have sufficient funds (or cash) to cover ancillary fees, the fees are subject to be allocated to the financial professional for any account regardless of the account program type.

Ticket Charges

| Product Fee Type | Fee Amount1 | Frequency | Included in WealthPort Program Fee |

|---|---|---|---|

| Stocks, Exchange Traded Funds (ETF)2 | |||

| International Surcharge/foreign receive and delivery fees2 | $50-$75 | Per International Security | |

| 144A/Reg S Exchange | $50.00 | Per event | |

| Purchase Fee | $0-$19 | Per Transaction | X |

| Penny Stock (Low Priced Speculative Securities not traded on an exchange under $5.00) | $74.00 | Per Transaction | Not allowed on the WealthPort Program |

| Redemption Fee | $19.00 | Per Transaction | X |

| Post Settlement Correction Fee | $5.00 | Per Transaction | |

| Mutual Funds | |||

| Periodic Investments Purchase Fee | $0.50 | Per Transaction | X |

| No Transaction Fee (NTF) Mutual Funds3 | $0.00 | Per Transaction | |

| Purchase Fee | $0-$19 | Per Transaction | X |

| Redemption Fee | $0-$19 | Per Transaction | X |

| Post Settlement Correction Fee | $5.00 | Per Transaction | |

| Fund Family Surcharge Fee for Purchase or Redemption for following funds: | $10.00 | Per Transaction | X |

| Options | |||

| Purchase Fee | $0-$19 + $2 Per Contract | Per Transaction | X |

| Redemption Fee | $0-$19 + $2 Per Contract | Per Transaction | X |

| Post Settlement Correction Fee | $5.00 | Per Transaction | |

| Fixed Income - Corporates, Municipals, Governments, Treasuries, Certificates of Deposit, CMOs, Mortgage-backed Securities, Structured Products, etc. | |||

| Clearing Charge - Agency Trades | $30.00 | Per Transaction | X |

| Clearing Charge - Principal Trades | $39.00 | Per Transaction | X |

| Post Settlement Correction Fee | $5.00 | Per Transaction | |

| Unit Investment Trusts (UITs) | |||

| Purchase Fee | $30-$39 | Per Transaction | X |

| Redemption Fee | $30-$39 | Per Transaction | X |

| Post Settlement Correction Fee | $5.00 | Per Transaction | |

| Precious Metals | |||

| Purchase Fee | $45.00 | Per Transaction | X |

| Redemption Fee | $45.00 | Per Transaction | X |

| Post Settlement Correction Fee | $5.00 | Per Transaction | |

| Alternative Investments (Defaults to Client) | |||

| Purchase Fee | $50.00 | Per Purchase | |

| Redemption Fee | $50.00 | Per Redemption | |

| Miscellaneous Fee | |||

| Commission Account Service Charge | $3.50 | Per Trade | Not Applicable for WealthPort Accounts |

1 Custom pricing may be available for offices with large trading volumes. Please contact your Cambridge Regional Director for more information.

2 Listed stock and ETFs (i.e. stock and ETF orders greater than 4999 shares) may incur a half-a-cent per share charge, which if incurred, will be charged to the advisor. Please contact Cambridge's Trade Desk prior to placing such orders to discuss alternatives.

3 This fee may be charged on securities held in safekeeping, cleared, and/or settled by a foreign entity.

Ancillary Charges

| Account or Service | Fee Amount | Frequency | Included in WealthPort® Program Fee |

|---|---|---|---|

| Inactivity fee – accounts with mutual funds only (retail accounts custodial fee)** | $17.50 | Annual | |

| Inactivity fee – standard (retail accounts and custodial fee)** | $35.00 | Annual | |

| Paper Subscription Fee (Fee for the paper delivery of documents such as statements, trade confirmation, prospectus, and other notifications and letters) | $2.00 | Per month | Fee does not apply to CAAP and UMA accounts. |

| Paper Tax Document Fee | $10.00 | Annual | Fee does not apply to CAAP®1 and UMA accounts. |

| 529 annual maintenance fee (pass through from American Funds)*** | $10.00 | Annual | |

| 529 set up fee (pass through from American Funds)*** | $10.00 | One time | |

| 529 transfer fee | $95.00 | Per 529 transfer | |

| DRS transfer** | $10.00 | Per DRS transfer | |

| Legal transfer fee/GNMA bond transfer** | $135.00 | Per transfer | |

| Outgoing transfer fee – retail accounts** | $125.00 | Per transfer | |

| UBTI tax filing fee** | $200.00 | Annual | |

| Year-end account report** | $3.00 plus postage/handling | Annual | |

| Retirement Account Fees | |||

| 403(b)(7), SIMPLE IRA Plan, Prototype SEP IRA maintenance fee** | $58.50 | Due at account set up and annually thereafter | X |

| Conversion from regular IRA to mutual fund only IRA** | $50.00 | Per conversion | |

| IRA maintenance fee – mutual fund only IRA** | $12.50 | Annual | X |

| IRA, Roth IRA, 5305-SEP, and Education IRA maintenance fee** | $43.50 | Annual | X |

| Pershing Individual 401(k), Simplified 401(k), Simplified Profit Sharing, and Simplified Money Purchase Plan maintenance fee** | $75.00 | Due at account set up and annually thereafter | X |

| Qualified Retirement Plans (QRPs) – Pershing Flexible is 401(k), Flexible Profit Sharing and Flexible Money Purchase Plan maintenance fee** | $125.00 | Due at account set up and annually thereafter | X |

| Termination fee (retirement accounts)** $43.50 annual IRA maintenance fee (termination or maintenance fees will be charged to accounts that are closed on the 7th calendar day to the financial professional) | $143.50 ($100 termination) | Closure of account | |

| Cash Management Services | |||

| ATM/Debit Card | |||

| ATM out-of-network surcharge fee (ATM not on PNC Bank or Allpoint network) | Various | ||

| Cash advance fee (nonATM)** | 0.25% or $2.50 minimum | Per transaction | |

| Corestone Silver | $25.00 | Annual | |

| Corestone Silver Plus** | $50.00 | Annual | |

| Corestone Gold ** | $100.00 | Annual | |

| Corestone Platinum** | $150.00 | Annual | |

| Corestone Gold Corporate** | $150.00 | Annual | |

| Corestone Platinum Corporate** | $250.00 | Annual | |

| Corestone business check – initial order** | $50.00 – One time purchase includes business binder, business register, deposit tickets, and 252 checks | ||

| Corestone carbon copy checks – initial order** | $15.00 | ||

| Corestone carbon copy checks – reorder checks** | $25.00 per reorder | Per reorder | |

| Corestone personal checks – initial order** | No charge | ||

| Corestone personal checks reorder for Silver and Silver Plus** | $12.50 | Per reorder | |

| Corestone personal checks reorder for Gold and Corporate Gold** | $10.00 | Per reorder | |

| Corestone personal checks reorder for Platinum and Corporate Platinum** | $7.50 | Per reorder | |

| Foreign transaction (Visa fee for transactions outside U.S) | 1% of the transaction | Per transaction | |

| Overnight debit card fee** | $25.00 | Per request | |

| Visa paid draft copy** | $2.50 | Per draft copy | |

| Checks | |||

| Corestone business check binder – reorder** | $20.00 | Per reorder | |

| Corestone business check – reorder checks** | $40.00 | Per reorder | |

| Corestone check copy** | $2.50 | Per check copy | |

| Corestone overnight checkbook fee** | $20.00 | Per reorder | |

| Corestone returned check fee** | $25.00 | Per returned check | |

| Corestone stop payment fee** | $25.00 | Per stop payment | |

| IRA resource check copy** | $2.50 | Per check copy | |

| IRA resource checking overnight checkbook fee** | $20.00 | Per overnight reorder | |

| IRA resource checking personal checks – initial order | No charge | Includes deposit tickets and 10 checks | |

| IRA resource checking personal checks – reorder checks | No charge | ||

| IRA resource checking return check fee** | $20.00 | Per returned check | |

| IRA resource checking stop payment fee** | $10.00 | Per stop payment | |

| Other Cash Management Services – Check Request | |||

| Margin extension** | $20.00 | Per extension | |

| Overnight courier fee** | $12.00 or $18.00 on Saturdays | Per request | |

| Returned ACH or check fee** | $20.00 | Per returned item | |

| Stop payment/stop check fee** | $10.00 | Per stopped payment | |

| Wire transfer fee** | $20.00 | Per wire request | |

| Investment Specific | |||

| Alternative investment subscription, redemption, or re-registration fee** | $50.00 | ||

| Employee stock option plan (ESOP)** | $50.00 | ||

| Safekeeping fee** (domestic and foreign) per position | $2.00 | Per month | |

| Special products fee (alternative investment fee)*** | $125.00 for non-registered positions | Annual | |

| Special products fee (alternative investment fee)*** | $35.00 for registered positions | Annual | X |

| Transfer agent fee for processing physical securities** | Varies by transfer agent | Per stock deposit | |

| Transfer and ship – DRS eligible securities (incoming statement sent to transfer agent) | *Computershare, Wells Fargo, and Registar and transfer Company = $15.00 ***American National Stock (AST) = $10.00 | ||

| Transfer and ship – DRS eligible securities (outgoing statement sent to transfer agent)** | $15.00 | ||

| Voluntary reorganization** | $25.00 | Per reorganization | |

| European Economic Area Specific (principally, this applies to equity securities with voting rights that are admitted for trading on a regulated market within the European Economic Area (EEA), and whose issuer has a registered office within the EEA.) | |||

| Annual vote instruction – noting | $5.00 | Per event | |

| Euroclear DWAC Processing Fee | $150.00 | Per event – effective May 15, 2025 | |

| General meeting announcements and proxy voting (e-Delivery and investor mailbox) – notification | $0.50 | Per event | |

| General meeting announcements and proxy voting (e-Delivery and investor mailbox) – voting | $2.00 | Per event | |

| General meeting announcements and proxy voting (Proxy Edge) – notification | Up to $2.00 | Per event | |

| General meeting announcements and proxy voting (Proxy Edge) – voting | Up to $2.00 | Per event | |

| Foreign/Regulatory/Disclosure | |||

| Non-U.S. (“Foreign”) Account Fee | $50.00 | Annual – effective May 15, 2025 | |

| Puerto Rico Tax Reporting Fee | $50.00 | Per filing – effective May 15, 2025 | |

| SEC Section 31 | $0.00 per $1 million for covered sales | Per transaction – effective May 15, 2025 | |

| Shareholder disclosure notifications for intermediary accounts – notification | $1.50 | Per event | |

| Vote instruction requiring supplemental information/documentation – voting | $3.00 | Per event | |

Asterisks show who the charges defaults to and who can pick up the charge:

*Defaults to the financial professional.

**Defaults to the client, but the financial professional may choose to reimburse.

***Client charge only.

1CAAP® is a registered mark of Cambridge Investment Research, Inc. for its program for investment managers.

Note: If an account does not have sufficient funds (or cash) to cover ancillary fees, the fees are subject to be allocated to the financial professional for any account regardless of the account program type.

Charges are subject to change.

Technology

Take your business to the next level with cutting-edge technology solutions.

CLIC® is an integrated digital suite of customizable technology that are continually being enhanced to allow financial advisors to do business wherever, whenever, and however they choose. Streamline running your business and managing your clients.

Fidelity Institutional® Wealthscape

Pershing NetX360+®

Add, edit, and search clients and account data for new account openings and updates

Account forms generation

eSignature

Institutional trading

Auto-open brokerage account types at clearing firms

Option to utilize automated Payment on Demand system for out-of-cycle ACH/EFT payments (advances)

Real-time interactive compensation reporting

Advertising submission and review

Correspondence submission and review

Trade Review

Checks and receivables blotter and direct trade blotter

SmarshEncrypt

Hearsay or MyRep Chat - compliance texting solutions

Web-based document image capture and submission to home office

Search and retrieve account paperwork

Store and retrieve other client documents (e.g., wills, tax returns, meeting notes)

Fee billing

WealthPort®

Simplified experience for setting up and servicing retirement plan accounts with integrations to supplement the fiduciary process

Automatic account opening and straight-through processing

Automatic forms population – supported by QUIK! Forms

eSignature via DocuSign

Electronic account signoff by supervisors

In-depth compensation reporting

Electronic application submission and document retrieval

Electronic correspondence, advertising submission, and retention

Transparent service request tracking

CLIC

CLIC

Digital wealth at your fingertips.

CLIC Advisor is an extension of Cambridge’s digital workstation and is available with eMoney.

Features Include:

Unified user experience

Mobile access

Advanced analytics

Collaborative client engagement

Comprehensive financial planning

Unlimited secure storage

Client education and direct marketing materials

FinTech Add-ons with CLIC Advisor

- Integrations and discounts available with providers such as Redtail, Wealthbox, Morningstar®, Nitrogen*, HiddenLevers, Bamboo: Marketing Upgrade, eMoney, Salesforce, and MoneyGuidePro

- Cambridge has also designed customized Redtail and Wealthbox workflows to help financial advisors develop and refine their core systems. Financial advisors may apply these workflows to their CRM system to quickly get up to speed in delivering an outstanding client service experience.

*Previously RiskAlyze

Take the next step in engaging with your clients.

CLIC Client serves as a personal finance website helping you engage with your clients.

Features Include:

- Mobile web access for clients

- Custom branding

- Client account aggregation

- Access for all clients

- Goals-based financial planning

- Unlimited secure storage

- Lead capture

- Advanced analytics

CIRStatements (Pershing X*) is a robust consolidated reporting tool which allows for the creation of aggregated, customized reports on client assets. It also features client-level access, making it easier for clientele to see their entire portfolio. Customize the level of access for the client to limit the reports they have access to.

CIRStatements Includes:

Aggregation of outside assets

Client portal that is consolidated and accessible from the financial advisor's website

Consolidated client accounts for the financial advisor

Custom reports created on demand, which are available to print, link, and send to clients detailing holdings, transactions, and performance

Option to add financial advisor branding to client reports

* Previously Albridge

- CIRConnect allows Cambridge's consolidated statement and performance reporting tool, CIRStatements, to interact with your critical desktop applications, specifically contact relationship management, financial planning, and analysis applications

- You must be a user of CIRStatements in order to use CIRConnect

Using role-based entitlements, CLIC Dashboard delivers an experience based on the user's unique needs. Leverage this centralized location to view, filter, group, and export data related to your book of business.

Cambridge’s partnership with AdvicePay offers financial advisors a flexible way to manage client subscription models, flat fee-for-service, or hourly services. AdvicePay facilitates client payments using check, credit/debit card, or bank account using ACH. Clients invoiced through AdvicePay are also offered online access to manage payment methods and view previous or upcoming invoices.

- Invoice for subscription models, flat fee-for-service, or hourly services

- Provide clients a no-hassle way to set up one-time or recurring payments for financial planning services

Several factors can influence your choice of financial planning tools, including your past experience with different programs, personal preferences, ease of use and implementation, and cost. Many of our partnered vendors offer a complimentary 30-day trial to let you test their programs firsthand. We encourage you to take advantage of these opportunities whenever they’re available.

Vendors:

- Advicent

- Advisys

- Asset-Map

- Elements

- eMoney Advisor

- Envestnet MoneyGuide

- Fidelity Retirement

- Income Conductor

- MoneyGuidePro

- Moneytree

- RetireUp

- RightCapital

Finding the right technology for your business is one of the fastest ways to boost efficiency and drive profits—and we’re here to help you do just that. Take advantage of our exclusive discounts with top CRM providers, including:

- Advisor Assistant

- Ebix SmartOffice®

- Equisoft/Connect

- Junxure

- Practifi

- Redtail Technology

- Wealthbox

Access to the latest market trends and financial product insights is crucial. Powerful research and reporting tools keep you informed, help you evaluate investment opportunities confidently, and enable you to deliver well-informed recommendations to your clients.

The following tools are available to you:

- AdvisoryWorld ICE

- Fidelity Institutional® Wealthscape Research Center

- FinaMetrica

- Hidden Levers

- Kwanti

- Morningstar Advisor Workstation

- Pershing NetX360 Research Center

- Nitrogen*

- Orion Risk Intelligence

- Tolerisk

- Totum Risk

- YCharts

- Zacks

*Previously RiskAlyze

Equip your administrative professionals—licensed and unlicensed alike—with a powerful, integrated suite of tools designed to handle your business’s critical tasks efficiently and confidently.

- CLIC Advisor

- CLIC Client

- CLIC Dashboard

- CLIC New Account Open

At Cambridge, we embrace cutting-edge technology to help you stay ahead. With the growing capabilities of Artificial Intelligence (AI), you have the opportunity to integrate smart, flexible solutions into your business.

To protect your clients and your business, any AI tools that access private client data or sensitive business information must first be reviewed under our vendor due diligence policy. Additionally, AI-generated transcriptions or outputs shared with clients must meet standard correspondence requirements.

Your clients trust you to keep their information secure. By using only Cambridge-approved AI tools, you ensure compliance, maintain confidentiality, and safeguard your business.

Events

Stay ahead and stay connected.

With 25+ events each year, you’ll gain timely insights and build meaningful connections. No matter your niche, our tailored, high-impact content meets you where you are.

Featured Live Events

National Event – Ignite

Ignite is more than just an event—it’s an immersive experience. Financial advisors and their teams come together to connect with Cambridge leaders, sponsors, and peers in a vibrant, engaging atmosphere. Packed with fun activities, insightful educational sessions, small group discussions, motivational speakers, and much more. Ignite offers endless opportunities to learn, grow, and build lasting relationships.

Accelerate

Accelerate is an exclusive event celebrating the critical role support staff play in your business. It empowers attendees with the knowledge and tools to elevate their impact and fosters meaningful connections with peers to inspire lasting success.

Cambridge Community of Women Forum

At our annual forum, the community gathers for insightful educational sessions and meaningful networking with CEO Amy Webber, peers, and Cambridge leaders—all focused on driving greater gender diversity within the advice industry. This important conversation continues year-round through our monthly webinar series.

Retirement Plan Summit

A premier educational event designed for financial advisors looking to expand their retirement plan business. Connect with ERISA attorneys and industry experts as they share proven growth strategies, tackle plan sponsor risk mitigation, and unveil effective approaches to help participants achieve their ultimate retirement readiness goals.

Recognition Events

Recognition events provide an exclusive, intimate setting in sought-after locations, offering one-on-one access to Cambridge executive leadership. These invitation-only gatherings celebrate the exceptional achievements and performance of qualifying financial advisors.

2025 Cambridge Recognition Events and Qualifications

| Recognition Event | Personal Business Development | Office Business Development |

|---|---|---|

| Circle of Excellence | $1,500,000 + | $4,500,000 + |

| Premier Club | $1,000,000 - $1,499,999 | $3,000,000 - $4,499,999 |

| Signature Club | $750,000 - $999,999 | $2,250,000 - $2,999,999 |

| Leaders Club | $500,000 - $749,999 | $1,500,000 - $2,249,999 |

Qualification for attendance at these events is based on annualized production from October 1, 2023, through September 30, 2024, and is non-transferable.

Support for Recruiting Offices

If you’re a business manager focused on recruiting financial advisors to your firm to expand your business, Cambridge considers you a recruiting office and an important long-term partner. Growing your business through recruiting is an effective and rewarding strategy to reach your growth goals.

We are committed to recruiting through our partnership with recruiting offices and recognize it as an innovative, sustainable growth strategy. We consistently partner with offices that actively recruit, and in 2023, more than half of all new financial advisors joined Cambridge through an existing office.

Business Development Support

Our Business Development Directors collaborate with recruiting offices to answer questions and support you as you work to seal the deal with a recruit. Your dedicated director, familiar with the unique needs of a growing office, remains current on the competitive landscape and frequently collaborates with recruiting offices like yours to provide recruiting support.

Cambridge welcomes recruits to visit us at the home office, whether virtually or in person. We tailor the home office visit experience to focus on the topics that are the most relevant to the recruit.

Technology consultations and demos are available to help in your office's recruiting efforts, highlighting how Cambridge's digital solutions enable financial advisors to win, service, and retain clients – all while maintaining flexibility. With technology designed around the needs of financial advisors, we will show how our technology creates office efficiencies.

Leverage the Cambridge family of financial advisors and leaders to close more business. Invite your recruit to an event to have them begin building connections and experience our one-of-a-kind culture firsthand. We’re happy to offer this unique opportunity nationwide, with events hosted annually on various hot topics in the industry.

Cambridge’s Recruiting Website JoinCambridge.com: Provide the recruit with the JoinCambirdge.com URL or explore the site together for an elevated experience.

Cambridge’s Internal Website cir2.com: Provide the recruit with the cir2.com URL and credentials as a tool to highlight the variety of services supported through Cambridge. Explore the site with your recruit and access helpful information, FAQs, and more.

If you have an opening or exciting opportunity to fill within your office, your Business Development Director will help you get the word out.

We are proud to offer you access to the following to aid in your growth goals:

- Creation and distribution of sales letters

- Access to turnkey, customizable sales letters

- Access to turnkey sales emails

- Social media best practices

Leverage Cambridge’s existing marketing materials with your recruit. These materials can be used digitally or printed, and speaking to our value proposition and many programs and services.

We are proud to offer you access to items highlighting the following topics:

- Digital solutions

- Cambridge fast facts

- Ease of transition

- Outsourcing solutions

- Growth opportunities

- Support for financial institutions

- Insurance solutions

- Succession and acquisition solutions

- and more!

As a recruiting office, you’ll guide your recruits through their transition to Cambridge, but you do not have to do it alone. We understand efficient transitions are crucial to maintaining client satisfaction. Our Transition Team offers different levels of support based on your needs.

Prospecting Tools

Designed to “go wide,” prospecting tools reach a large group of financial advisors who meet your ideal profile. Your messaging should convey that your office’s strengths are backed by a national, internally controlled financial solutions firm – Cambridge. By combining your business's strengths with those of Cambridge, we present a compelling case for your opportunities. The goal is to be the office that recruits want to join.

We can help you connect with your ideal audience on a large scale and aid in your marketing efforts, so you can fill your open opportunity faster than ever.

Defining Your Audience

Unlock market opportunities through Discovery Data, a nationwide database of financial services and insurance professionals that offers a plethora of information to aid in your recruiting efforts. To help you find your ideal candidate, contact the Business Development Director and request a report be pulled from within the database.

Your Business Development Director will then discuss your open opportunity with you and work with you to define the parameters that will be most useful during your marketing campaign. Finally, your custom report will be delivered to you, increasing your overall reach.

Business Tools and Growth

We will support your goals with the helpful tools and resources provided by Cambridge’s experts.

Practice Management

Streamline operations, accelerate growth, and build equity with expertise from Cambridge’s Practice Management Team.

Consulting

Take advantage of one-on-one consultative sessions to determine your needs and create a support system to keep your business on track to meet your goals. Choose a consultation from a subject matter expert in the following areas. Other topics are available to suit the unique goals of your business.

Branding

Business growth

Digital strategy and social media

Practice management

Technology

Time management

Coaching

A short-term engagement lasting three or fewer months, designed to tackle your identified business challenges efficiently. You’ll be paired with a dedicated coach who will link you to training, resources, consultations, and educational opportunities to help you overcome obstacles and meet your goals.

Cambridge’s Real Practice Management (RPM) program combines the personalization of one-on-one coaching with the benefits of interactive peer group meetings so you can develop, implement, and achieve your goals purposefully.

Vision: Year One

Elevate your business through educational content and networking opportunities

Work closely with your coach to develop your business plan, marketing strategy, and continuity/succession plan

Focus: Year Two

Continue to work with your coach and develop a focused and strategic business continuity plan that covers three, five, and 10-year periods

Develop an office manual and disaster recovery plan

Recharge: Year Three and Beyond

Designed to keep you engaged and focused on industry topics so you can build on your success

Business Tools and Resources

Cambridge is proud to partner with Truelytics to bring you its complimentary practice management, business intelligence, and valuation tool to help you understand, create, and realize the value in your business.

Using Truelytics, you can personally model different numbers and scenarios for your business. An evaluation report will be created to help you understand business decisions and outcomes. Your evaluation report will identify strategies to improve value. Leverage scores and benchmarks to set priorities and identify ways to improve your business stability and productivity, prepare for an acquisition, develop individual continuity plans, and/or plan for future succession planning.

We recognize the most significant challenge in outsourcing is finding the right third party who understands you and the inherent complexities of our heavily regulated industry. Cambridge Source (Source) is our in-house solution for your common outsourcing needs, making selecting the right partner easy.

Use our Acquiring Staff suite to simplify your workload and focus on what matters most – your clients.

Offerings:

Office Assistant: Hire a knowledgeable assistant who works for you virtually from the Cambridge home office

HR Consulting: Partner with Cambridge’s HR Consulting Team to find the right person for your business

The Next Step Internship Program: Assists with recruiting, hiring, and training the next generation to work in your business

You've built a successful business. Now it's time to ensure you are set up for continued growth. Take advantage of these services to fine-tune your firm and give it the pieces it needs to stand out from the crowd.

Offerings:

Business Consulting: Analyze your practice and provide an evaluation of your current business model, identifying strengths, weaknesses, and areas for improvement

- Customized Marketing: Collaborate with our experienced copywriters and designers to create a monthly or quarterly newsletter your clients or prospects won’t soon forget. To save you even more time, your consultant can facilitate advertising review on your behalf through collaboration with our in-house Compliance Department.

- Social Media Support: Stand out and stay consistent across today’s top social media platforms. Our experienced consultants offer end-to-end social media support to help amplify your brand and engage your audience with confidence.

Website Design and Hosting: Work with our Source Marketing Team to create a modern, mobile, and search engine-friendly website that speaks to the professionalism of your business and what you do

Unlock your team’s potential with resources and tools that will help you and your staff expand your knowledge and consistently deliver exceptional client service. Programs are available for new and seasoned staff members.

Offerings:

Bring your new administrative hire up to speed on the financial services industry

Utilize new tools to manage client relationships and the day-to-day pressures of developing a new business

Unlock potential and gain insight into your team

Protecting your business is always top of mind. Source offers various options to ensure your clients and business are covered, so you can focus on the day-to-day operations.

Offerings:

Cybersecurity Services: Cyber-attacks are a growing threat to all businesses. Source has partnered with several industry partners to bring you a cybersecurity solution to help control and protect your technology systems from ongoing cybersecurity threats.

Technology Services: Leverage our in-house IT Team to protect your devices, back up your data, and review your technology needs regularly

Beneficiary designations and rules

Charitable giving strategies

Education funding

Estate planning

Fiduciary responsibilities

Income distribution

IRA rules

Retirement planning

Social Security planning

Tax planning

Trust planning and trust service guidance

Retirement income planning solutions

Retirement product due diligence tools

Retirement/tax planning calculators

Networking and Mentorship

Cambridge Nation is a private online community for Cambridge financial advisors to share, recommend, brainstorm, and connect with peers – anytime, anywhere. Mobile-friendly, users can choose to receive email copies of discussion posts, with options for receipt of email digests that make it easy to keep up with perspectives and insights from Cambridge peers.

Synergy Exchange, a feature within Cambridge Nation, is an online networking tool designed to help Cambridge financial advisors find and connect with others. Whether new to the financial services industry or an experienced financial advisor, mentoring can be a valuable tool to help take your business to the next level.

Client Solutions

The marketplace regarding annuities, insurance, advisory products, and securities is rapidly changing. You have a partner on our Client Solutions Team who will work with you to ensure your business evolves for the future.

- Fee-based Solutions: Guidance to streamline your business using an array of fee-based strategies

- Insurance Solutions: Receive no-nonsense advice on industry trends, including legislative changes that impact your business

- Investment Solutions: Offering many different vendors and options of financial planning programs, an extensive list of third-party money managers, as well as cash and cash alternatives

- Private Client Solutions: Leverage firm-wide subject matter experts to support the complex financial needs of your high-net-worth and ultra-high-net-worth clients

- Retirement Plan Solutions: Delivering retirement plan tools and expertise enabling you to better prepare your clients for their life journey

Succession and Acquisition Solutions

We value independence and understand that protecting the value of your business is critical. Whether you need a solution for an OSJ, a backed and funded plan, or a multi-level plan to accelerate growth to bolster valuation, you will find a knowledgeable, in-house partner to work with and guide you through the process.

Our Succession and Acquisition Solutions Team can help in creating a customized continuity plan and, when the time is right, a formal succession plan for retirement, complete with a consultation on the financial options available.

These consultants can even introduce you to fellow Cambridge financial advisors to partner with for emergency business continuity planning, longer-term acquisition, or succession planning. If you are looking to grow through an acquisition, we will deliver the resources, education, and guidance to help you through the process, to a successful conclusion.

Continuity Express

Supplying the security and protection you deserve.

Available exclusively to Cambridge financial advisors, Continuity Express® will help you get started on long-term planning by putting an emergency continuity plan in place. Continuity Express offers a smart, easy-to-implement solution, supplying a base level of security for your family, staff, and clients in the event of an untimely occurrence.

If an emergency arises, an elite cross-departmental group will provide on-site support to your business to aid in daily operations and servicing your clients.

Customized Managed Account Solutions

Click each listed item to learn more or to view a full list of available offerings.

WealthPort

WealthPort® is Cambridge’s flexible managed account solution built to support your unique business model—no matter how you serve your clients. Whether you manage portfolios directly or outsource investment management, WealthPort offers streamlined tools, scalable service, and time- and cost-saving efficiencies. It’s all designed to help you spend more time where it matters most: deepening the client experience.

True to our core value of flexibility, WealthPort is available through Cambridge Investment Research Advisors (CIRA) or an independent registered investment adviser (IRIA).

WealthPort advisor-directed gives financial advisors the ability to act as portfolio managers while maintaining full control of the client relationship. Through the WealthPort Block Trading platform, you can access a broad range of investment products and streamline key tasks such as model creation, trading, and account management.

Tools available within the WealthPort Block Trading platform include:

- Rebalancing

- Security swaps

- Single multiple-order entry

- Trade to target

- Worksheet trading

Account Minimum

Accounts begin at $5,000. The minimum is waived if the household contains an account with a minimum of $25,000.

WealthPort's team-directed solution allows your office to standardize investment strategies by offering shared models across the team. Assign a designated trader to manage all accounts tied to those models and execute trades through the WealthPort Block Trading platform—helping your team scale efficiently and deliver consistent client service.

CAAP®¹ offers access to a broad range of third-party strategists and models to help you align investment solutions with your clients’ goals, values, and risk preferences. By outsourcing portfolio management, you gain more time to focus on the client relationship while leveraging a sophisticated, institutional-quality investment platform.

- Mutual fund/ETF models

- Small account solutions

- Tax-aware

- Retirement income

- Equity SMA portfolios

- Social and Sustainable Investing

Account Minimum

- Small account solutions begin at $5,000

- Standard single strategy models begin at $50,000

Combine multiple CAAP® strategies and individual securities in a single account with the WealthPort UMA solution. Designed for high-net-worth clients, UMA offers streamlined access to a range of asset classes while enabling deeper customization and the flexibility to outsource to trusted CAAP strategists.

- Customization

- Diversification

- Sophistication

Account Minimum

Accounts begin at $100,000. Accounts may be split between multiple CAAP strategies with a minimum $50,000 in each strategy or a combination of CAAP strategies and Equity SMA portfolios.

If including Equity SMA portfolios, a minimum of $100,000 is required

Additional Asset Management Options

The Cambridge Managed Account Platform (CMAP) is a flexible, unbundled, advisor-directed solution that gives you the freedom to build client portfolios using a broad range of investment options, including general securities, load and no-load mutual funds, bonds, and more. The platform supports both discretionary and non-discretionary trading and offers electronic trading for added efficiency.

Account Minimum

- Accounts begin at $25,000. The minimum is waived if the household contains an account with a minimum of $25,000. Account minimums do not apply to retirement accounts.

Cambridge supports multiple business models, including fee-based and fee-only structures, as well as one-time and subscription-based financial planning services. Advisors may use a variety of financial planning software programs and choose from hourly, flat-fee, or asset-based billing methods. Financial planning fees under the Cambridge RIA count toward revenue, while fees earned under an independent RIA (IRIA) may be retained in full by the IRIA and do not count toward revenue credit.

Unlock powerful trading capabilities with the Flexible Managed Account Platform (FlexMAP). Gain seamless access to top custodians like Fidelity Institutional®, Pershing Advisor Solutions, and Charles Schwab—letting you leverage advanced electronic trading systems and premium services designed to elevate your business.

Cambridge offers one of the most extensive selections of third-party money managers and platform providers in the industry, giving financial advisors the flexibility to align investment strategies with each client’s unique needs—whether through turnkey solutions or specialized approaches.

¹CAAP® is a registered mark of Cambridge Investment Research, Inc. for its program for investment managers.

Investment Solutions

Quality and choice are equally important, so we offer one of the industry's broadest product footprints while maintaining thorough due diligence. Click each item listed in this section for a detailed list of eligible product companies you may choose to work with.

Choose from many different companies and products to meet your clients’ needs.

| Ares-Black Creek | Bluerock |

| Cantor Fitzgerald | Cottonwood Communities Inc. |

| FS Investments | Hines |

| Inland Real Estate Investment Corp. | Invesco |

| Jones Lang LaSalle | Nuveen |

| RREEF | Sealy & Company |

| Starwood Capital | Strategic Storage-Pacific Oak |

| The Blackstone Group |

- Braemar

- CIM Group

- Preferred Capital Securities

- Griffin Capital

- Cantor Fitzgerald

- Apollo Global Management

- Blackstone

- Blue Owl-Owl Rock

- CNL

- Goldman Sachs Exchange Fund

- ICapital KKR Commitments Fund

- Keystone National Group

- Ironwood Partners

- Bluerock

- Cantor Fitzgerald

- Inland

- Passco

- APX

- Mewbourne

- US Energy

| Blackcreek | BlackRock |

| Blackstone | Bluerock |

| CIM Real Assets | CION Ares |

| Clarion Partners | Conversus StepStone Private Markets |

| FS Credit Income | Griffin Capital |

| Goldman Sachs | Invesco |

| PIMCO | VOYA |

| Absolute Advisers | Alger | AllianzIM |

| American Beacon | Anchor | AQR |

| Arbitrage Funds | Assetmark | AXS Investments |

| BlackRock | BNY Mellon | Brinker |

| Calamos | Cambria | Catalyst |

| CMG | Direxion | Eaton Vance |

| FirstTrust | Franklin Templeton | FS Investments |

| GlobalX | Guggenheim Funds | Horizon |

| iM Global Partners/PartnerSelect Funds | IndexIQ | Innovator |

| Invesco | John Hancock | J.P. Morgan |

| LoCorr | Meeder | Morningstar |

| Natixis | Nuveen | PIMCO |

| Proshares | Rational Funds | Rydex |

| Swan | WisdomTree |

Cambridge offers a robust list of variable and fixed-indexed annuities to meet the ever-changing needs of your clients.

| AIG Variable Annuities | Allianz | Ameritas |

| Athene | Brighthouse | CUNA Mutual Group |

| Delaware Life | Equitable | Forethought-Global Atlantic |

| Great American | Integrity Companies (W & S) | Jackson National Life |

| Kansas City Life | Lincoln Financial | Nationwide |

| Nationwide Advisory Solutions | New York Life | Pacific Life |

| Principal | Protective Life | Prudential |

| Sammons Retirement Solutions | Securian/Minnesota Life | Security Benefit |

| Transamerica |

| Allianz Life | American Equity | American General |

| ANICO – American National | Athene | Delaware Life |

| Eagle Life | Fidelity & Guaranty (F&G) | Gleaner Life |

| Global Atlantic (Formerly Fore Thought) | Great American | Integrity Life |

| Jackson National Life | Lafayette | Lincoln Financial Group |

| Midland National | National Life Group | National Western |

| Nationwide | North American | OneAmerica (State Life) |

| Pacific Life | Protective | Prudential |

| Reliance Standard | Sammons | Securian |

| Security Benefit | Symetra | The Standard |

| United Life | US Life (AIG) |

Leverage one of Cambridge’s fixed income relationships for extensive search engines access, enter purchase orders online, request bids, and generate reports of potential bond purchases and bond ladders for portfolios.

Existing Relationships:

Advisors Asset Management (Pershing and Fidelity Institutional®)

Bond Trader Pro (Fidelity Institutional®)

Bond Central (Pershing)

Southwest Business Corporation (Fidelity Institutional®)

Frequently requested mutual fund companies include:

| American Funds | BlackRock |

| Federated | Fidelity Institutional® |

| Franklin Templeton | Invesco |

| J.P. Morgan | Lord Abbot |

| Oppenheimer | PIMCO |

| Putnam | T. Rowe Price |

| Vanguard | Virtus |

| Aberdeen Funds | AIG SunAmerica Funds | Alger Funds |

| AllianceBernstein Funds | Allianz Global Investors | Alpine Funds |

| American Century Funds | American Funds | American Pension Investors Trust |

| Aquila Funds | Ariel Funds | BMO Global Asset Management |

| Calamos Financial Services, Inc | Calvert Group Funds | Columbia Funds |

| Credit Suisse Funds | Davis Funds | Delaware Funds |

| Dodge & Cox Funds | Domini Social Funds | Dreyfus Funds |

| Dunham Funds | DWS Investments | Eaton Vance Funds |

| Eventide Funds | Federated Funds | Fidelity Funds |

| First American Funds | First Eagle Funds | Forward Funds |

| Franklin Templeton Funds | Goldman Sachs Funds | Guggenheim Funds |

| Hartford Funds | ICON Funds | IDEX Funds/Transamerica |

| Invesco Funds | IVA Funds | IVY Funds |

| John Hancock Funds | JP Morgan Funds | LAZARD Asset Management |

| Legg Mason | Lord Abbett | Mainstay |

| Manager Funds | Manning & Napier | MFS |

| Nationwide | NATIXIS Global Asset Management | NEUBERGER BERMAN |

| Nuveen | Oppenheimer | Pacific Funds |

| Pax World Funds | PIMCO Funds | Pioneer Funds |

| PNC Funds (formerly Allegiant Funds) | Praxis | Principal Funds |

| Pro Funds | Prudential | Putnam |

| Quaker Funds | Royce Funds | Thornburg |

| Timothy Plan | Touchstone | Tweedy Browne Funds |

| Van Eck | Virtus Investment Partners | Voya Investment Management |

| Wells Fargo Funds |

To help streamline your business and client experience, Cambridge uses SIMON as an all-in-one, interactive technology platform to offer structured products.

Cambridge offers a robust list of College Savings Plans to meet the needs of your clients as their goals evolve.

| American Century Investment Services, Inc. | American Funds | Ascensus College Savings |

| BlackRock | College Savings Bank | Columbia Funds |

| Fidelity Investments | First National Bank of Omaha | Franklin Templeton |

| Hartford | Invesco | IVY Funds |

| John Hancock | J.P. Morgan | MFS |

| Northern Trust Securities, Inc. | NorthStar | Nuveen |

| Nuveen Securities LLC | Principal | Putnam Investments |

| Union Bank & Trust Company | Virtus Investment Partners | Voya |

- American Funds

- BlackRock

- Fidelity Investments

- American Funds

- John Hancock

- Voya

Choose a direct Health Savings Account (HSA) or an HSA through Fidelity Institutional® or Pershing. Cambridge offers the flexibility to work with other HSAs if properly registered as an outside business activity.

Cambridge offers a variety of recordkeeping platforms to meet the needs of your diverse plan sponsor relationships.

| ADP | Alerus Retirement and Benefits * | American Funds * |

| American Trust Retirement *^ | Ameritas * | AMI Benefit Plan Administrators, Inc. * |

| Ascensus * | AssetMark, Inc. * | AXA * |

| Benefit Consultants Group *^ | BlueStar * | BPAS * |

| California Pension Administrators & Consultants *^ | Cambridge Retirement Plan Strategies (RPS) * | Cambridge RPS Turnkey * |

| Coastal Daily Balance * | CUNA Mutual Retirement Solutions * | Digital Retirement Solutions * |

| Employee Fiduciary * | Empower-Retirement * | EPIC Advisors * |

| ePlan Services ^ | Fidelity * | Future Benefits of America * |

| Guideline | Heritage Pension Advisors, Inc. * | John Hancock |

| JP Morgan | July Business Services * | KTRADE *^ |

| Lincoln * | Mutual of Omaha | Nationwide * |

| Newport Group * | Northwest Plan Services, Inc. * | OneAmerica * |

| Orion / FTJ Fundchoice | Pai ^ | Paychex * |

| Pentegra *^ | Principal * | Professional Capital Services (PCS) * (FKA Aspire) |

| Prudential * | Retirement Plan Consultants *^ | Retirement Strategies Group * |

| RPG Consultants * | Schwab | Securian * |

| Security Benefit * | Sheakley Workforce Management, LLC * | Spectrum Employee Benefits *^ |

| Sunwest Pensions * | T. Rowe Price | The Standard * |

| Touchstone Retirement Group * | Transamerica | Ubiquity |

| Vanguard * | Vestwell* | VOYA* |

* Also does 403(b) plans

^ Limited to only Matrix or Mid-Atlantic as the Custodian

Through Cambridge’s trust company relationships, access a variety of services including trust planning and administration, and accounting, tax, and insurance support.

- Accounting support

- Insurance support

- Tax support

- Trust planning and administration

- Independent Trust Company of America

- SEI Private Trust Company

- Capital First Trust Company

- Renaissance Trust Services

- Zia Trust, Inc.

Cambridge is pleased to offer you a variety of credit and lending choices.

- Goldman Sachs Select

- GS Select for Advisors

- U.S. Bank Private Banking

- Fully Paid Lending

- Margin Lending

- LoanAdvance™

- BNY Mellon

- Investment Credit Line

- Fully Paid Securities Lending

- Margin Lending

| 12th Street Asset Management | 3EDGE Asset Management | American Funds |

| Aristotle Capital Management | Atlanta Capital Management | Berkshire Asset Management |

| BlackRock | Boston Advisors | Brinker Capital |

| Capital Group | Dearborn Partners | Duff & Phelps |

| Fidelity | First Trust Advisors | Franklin Templeton |

| Goldman Sachs Asset Management | Harding Loevner | Horizon Investments |

| iM Global Partner | Invesco | J.P. Morgan Asset Management |

| Kayne Anderson | Kennedy Capital | Lazard Asset Management |

| Morningstar Investment Management | Nuveen | Ocean Park |

| OneAscent | PIMCO | Polen Capital |

| Portfolio Management Consultants (PMC) | Principal Global Investors | Renaissance Investment Management |

| Richard Bernstein Advisors (RBA) | Russel Investments | Schafer Cullen |

| SEI | State Street | Symmetry |

| Trillium | T. Rowe Price | Zacks Investment Management |

| 3D/L Capital Management, LLC. | Absolute Capital Management | Advisors Asset Management (AAM) |

| Advisors Capital Management | Aristotle | Beacon |

| BNY Mellon Wealth Management | BTS Asset Management | City National Rochdale Investment Management |

| Clark Capital Management Group (CCM) | CMG Capital Management Group | Dunham Funds |

| First Ascent Asset Management | Flexible Plan Investments, LTD | Frontier Asset Management |